Key Takeaways

- JPMorgan Chase has filed a trademark application for ‘JPMD’, possibly indicating new digital asset services.

- The application suggests features like digital currency issuance and real-time digital token trading.

Share this article

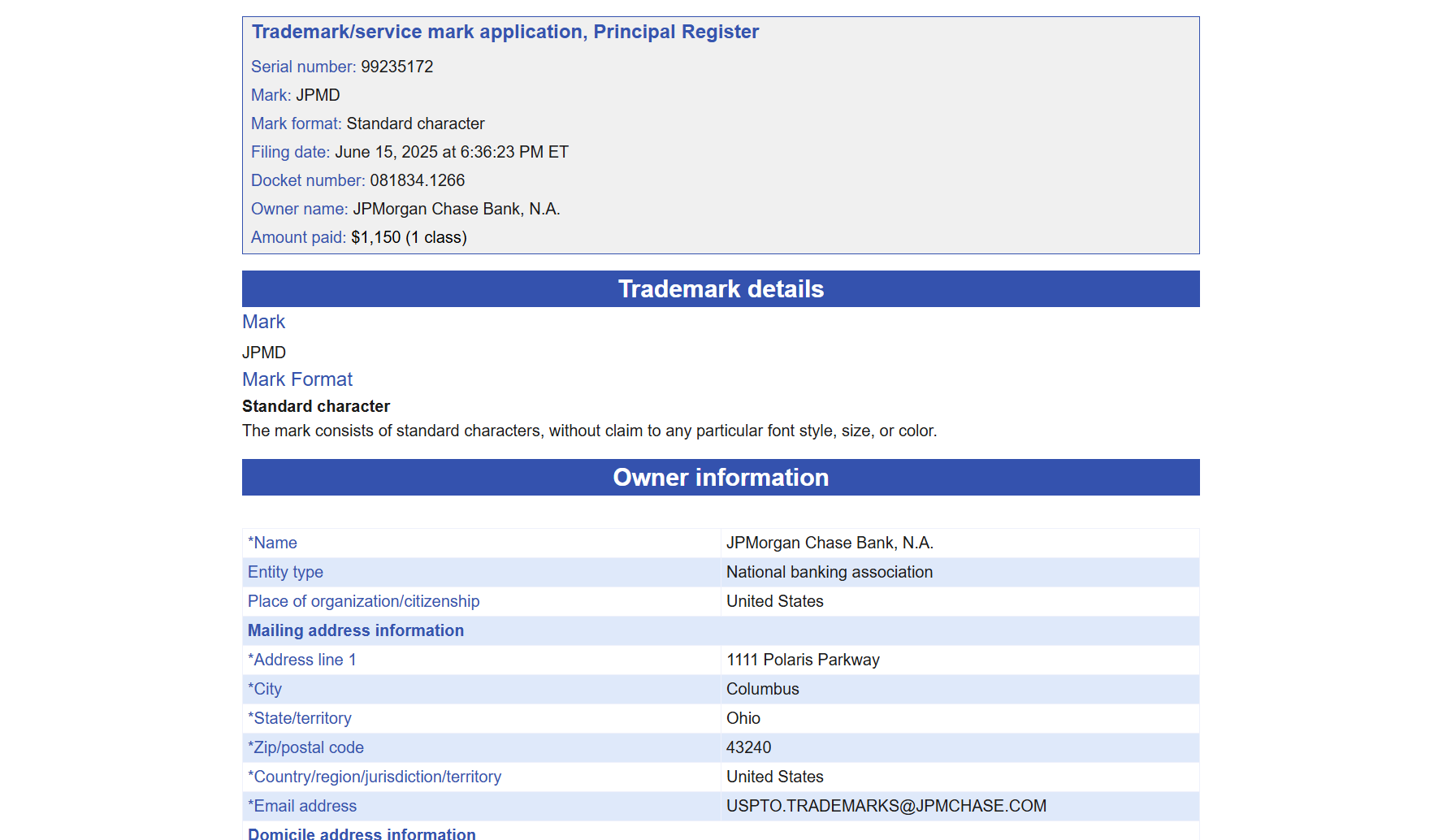

JPMorgan Chase is making fresh moves in the digital asset space with a newly filed trademark for “JPMD”, according to a June 15 submission to the US Patent and Trademark Office (USPTO).

The application, submitted by JPMorgan Chase Bank, N.A., covers a broad spectrum of digital asset and blockchain-related services, including digital currency issuance, electronic payment processing, and financial custody services, and it may signal the bank’s next evolution in stablecoin offerings.

This isn’t JPMorgan’s first foray into blockchain-based finance. The bank already operates JPM Coin, a dollar-backed stablecoin used to facilitate instantaneous payments between institutional clients. The token operates on the Quorum blockchain, a private blockchain network developed by JPMorgan based on Ethereum technology.

The move comes as JPMorgan Chase and other US banking giants are reportedly considering a collaborative stablecoin project through their jointly owned entities, Early Warning Services and The Clearing House. The initiative aims to compete with the rapid growth of digital asset platforms.

The project’s progress depends on regulatory acceptance and market demand, influenced by ongoing legislative developments such as the GENIUS Act, which is heading to a final vote this week.

Share this article